https://www.enchantingmarketing.com/metaphor-examples/

Preparing an investment application/pitch deck — a workbook for startups

Every Angel or VC is always searching for needles in the haystack, the 7–10 companies they fund from thousands of applications.

https://www.frontiersin.org/files/Articles/427884/fphy-07-00011-HTML/image_m/fphy-07-00011-g001.jpg

Importance of taking time to express your ideas clearly

So, what does it takes to get noticed? The questions of the pitch deck/application are usually similar. I use pitch deck and application interchangeably because it is usually the first thing investors look at.

From the perspective of an analyst evaluating an application, it is easy to identify a bad application. But some good applications also get rejected, an application where a promising concept is poorly described and does not create a ‘picture’ in the mind of a reviewer/investor.

It is important for a founder to spend time crafting a good application.

Visualize the sequence of application questions as creating a painting, one brushstroke at a time. The final picture becomes visible at the end. But the interest in each brushstroke as the image comes to life has to be consciously created. The goal of an entrepreneur is to create a vivid image in the mind of the investor. Vivid here implies clarity (simple), sharpness (easy to decipher), and graphic (granular details).

This is the job of an entrepreneur. Often tricky because entrepreneurs are too close to their business and their business value seems ‘obvious’ to them. The belief then is that it should be obvious to everybody.

Not so. Investors see so many pitches, are experienced, and respond spontaneously to information they read, very much like a sportsperson in a match.

Entrepreneurs must believe that investors are searching for the next big opportunity. They are positive people. Their questions attempt to confirm the value of the opportunity, quite unlike a project appraisal in a corporate setting. Risk is inherent in their choice-making.

Start-up

The first question, “Please describe your start-up in your own words.” This is the hook that should grab the reader. It should entice the person to start searching for answers in the application to discover reasons to support the idea expressed. The focus of this statement is not the product or service you make/deliver. The statement is written from a customer’s perspective and is created from the value that a customer realizes/experience. Highlight what you are planning to win.

By the time you finish, the reader should interpret the scale of the startup using the data presented. Help the reader realize the opportunity. Too big and dramatic the opening remark, inadvertently, the reader begins to search for flawed logic in the following information.

You must communicate the message in the first sentence using simple language that a 7 to an 8-year-old child can understand. The question to test the opening statement are — is it precise, concise, and straightforward. This could be a 5 to 8-word sentence on the landing page of a website that should draw a person to browse.

In the painting metaphor, the description is the framing of the opportunity. Best done without jargon, without exaggeration. A simple description is always better.

Team

The founding team drives new business creation and is a significant influence on the arduous journey of a start-up. Entrepreneurs are exceptional people. It is necessary to describe what each team member has created, done, and learned. Be specific. Tangibility is a firm brush stroke!

Think and discover what your founding team has done that makes them invaluable to the startup’s journey ahead. Describe the value, knowledge, and experience of the founding team that will contribute to technology, product development, go-to-market, and business growth.

Be candid about gaps, if any. Demonstrate that you are reflective and self-aware.

If investors like entrepreneurs as persons, they will want to meet them.

Problem and solution

Communicate the insight that triggered discovery/identification of the problem, which then motivated you to develop the solution. Ideas are often discovered during execution jointly with customers. This is also when the scale of the opportunity becomes visible, is corroborated.

This is where the unique insight that underpins the idea is made explicit, the next hook. Insights that are embedded in the customer experience.

This is where the value proposition becomes obvious.

This segment must be bullet-proof. Entrepreneurs must demonstrate that they have thought deeply about all the potential weaknesses of their assumptions. Be candid about the issues that you foresee and how you intend to test and validate the assumptions.

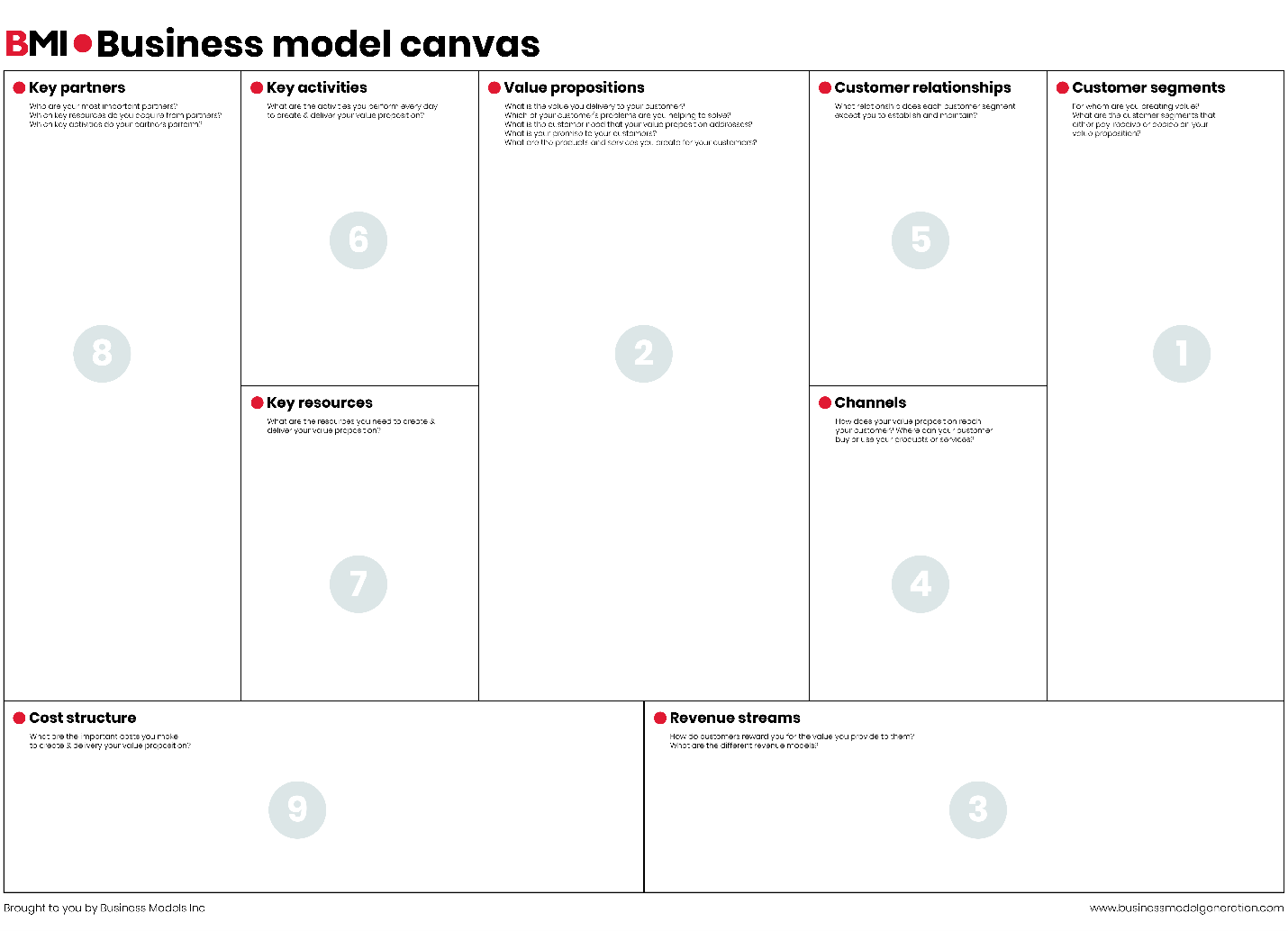

Business Model — what it is and what it is not

The term ‘Business Model’ can mean different things to different people. It is not the business model canvas.

https://www.businessmodelsinc.com/about-bmi/tools/business-model-canvas/

A business model describes how an organization creates, delivers, and captures value. To create value is to do something unique (a startup’s own) and different (differentiation in creating and positioning) that cannot or is difficult to copy. What will enable a startup to sustain its competitive edge? To deliver value requires an articulation of an ability to evoke interest in customers, convert interest to a cognitive commitment to analyze the offer versus competing offers, and then convert and serve. To capture value is more than pricing. In the development of a startup, value extraction is often qualitative. This is especially true in a digital world where a startup first acquires sticky customers before capturing value.

The response to the business model question gives investors an insight into the nature of the investment opportunity. They can visualize where the startup is on the development trajectory, know whether it is an investment opportunity, to establish the basics of the business (product development and customer acceptance) or growth (scaling).

While describing the business model, entrepreneurs establish the basis of their need for capital. They provide context for identifying what they can achieve in the business model (validation) or with the business model (growth).

The third opportunity while describing the business model is to show unit economics, how a startup makes (or plans to make) money. In the unit, the economics margin is often a surrogate measure of risk. A business model with high margins and low capital intensity allows an entrepreneur to learn, taking a longer time by making mistakes. And still having the capital to recover. Lower-margin business models with higher capital intensity are risky when faced with high customer acquisition costs, competitive pressures, or difficult economic conditions.

Traction is everything

Customer traction (engaged users and paying customers) means the product works, and a customer problem is being solved. A metric of consumer retention and loyalty is an indicator of growth potential. Virality can be engineered. The network effect is the nature of the business.

Traction quality is built during startup growth. Capital needed to build/manage traction quality is a good ask. The deployment of capital for marketing is not.

Traction is contextualized in the ‘valley of death.’

This is an opportunity for entrepreneurs to highlight that they have an edge to reach a target market, gaining acceptance of customers that is more effective than the competition, how their customer acquisition costs connect with average, and target revenue per customer. Their product sales cycle and cash cycle. Customers are required to break even. And so on.

Visualize a startup as having three layers — a customer engagement layer, the business process or transaction layer, and core or deep data. Value is increasingly embedded in customer engagement and deep data. A startup must demonstrate how they are (or will) be able to digitally create demand economies of scale in the engagement layer.

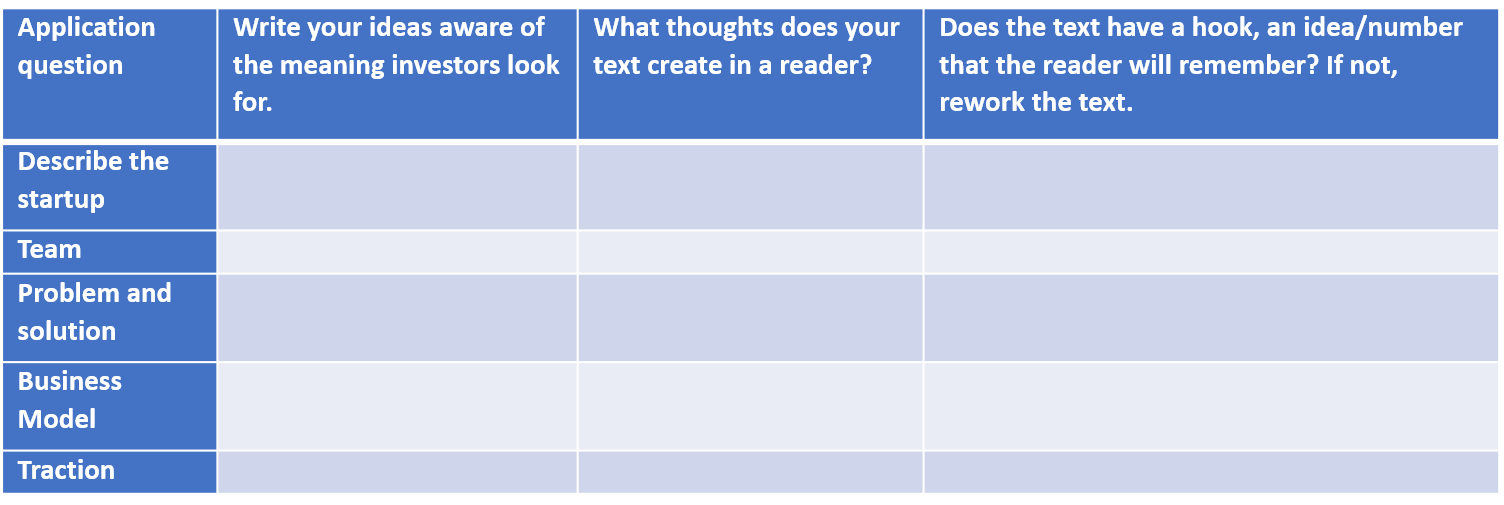

Workbook

Use the following table as a workbook. Fill it using the ideas suggested.